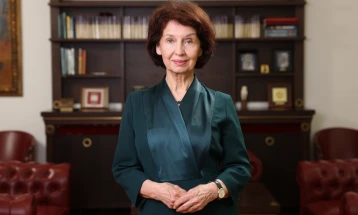

Angelovska-Bezhoska: Denar stability guaranteed, foreign exchange reserves higher compared to pre-pandemic period

- The stability of the denar is guaranteed thanks to the capacity and instruments available to the National Bank to defend the exchange rate of the domestic currency, particularly focusing on foreign exchange reserves, which are about 40% higher this year compared to the pre-pandemic period. Inflation is expected to stabilize gradually through next year. Future monetary policy will depend on inflation and foreign exchange market, National Bank Governor Anita Angelovska-Bezhoska said in an interview with Macedonian Television.

Skopje, 26 December 2024 (MIA) – The stability of the denar is guaranteed thanks to the capacity and instruments available to the National Bank to defend the exchange rate of the domestic currency, particularly focusing on foreign exchange reserves, which are about 40% higher this year compared to the pre-pandemic period. Inflation is expected to stabilize gradually through next year. Future monetary policy will depend on inflation and foreign exchange market, National Bank Governor Anita Angelovska-Bezhoska said in an interview with Macedonian Television.

According to the National Bank, Angelovska-Bezhoska underscored that, despite numerous challenges, the Bank successfully maintained macroeconomic stability and the stability of the domestic currency’s exchange rate against the euro through its measures. Regarding foreign reserves, the Governor underlined that their level, as a key tool for exchange rate stability, is significantly higher than in the pre-pandemic period. She explained this as a result of the National Bank’s ongoing foreign currency purchase on the market over the past two years, amid a significantly more stable balance of payments, particularly in the trade account, remittances, and solid foreign investments.

In regard to the inflation, Angelovska-Bezhoska said that after an average inflation rate of 9.4% last year, it has decreased to 3.4% in the first ten months of this year, with further gradual easing expected next year. However, she also pointed to certain risks.

“It is important to note that the prices of primary commodities remain under considerable influence from geopolitical developments. This segment is still fragile, with significant uncertainty, necessitating great caution. Domestic factors, particularly the labour market, represent additional risk sources that must be carefully managed to avoid new inflationary waves,” she added.

The Governor noted that monetary policy will remain closely tied to inflation and the state of the foreign exchange market.

“If favourable trends continue, without major external or domestic shocks, there will certainly be room for further easing of monetary policy,” Governor Angelovska-Bezhoska said.

Photo: MIA and National Bank