Net external debt amounts to EUR 4,324 million in Q2 2023

- The net external debt in the second quarter of 2023 amounted to EUR 4,324 million (i.e. 30.5% of the forecasted GDP), the National Bank said in a press release on Friday.

Skopje, 29 September 2023 (MIA) – The net external debt in the second quarter of 2023 amounted to EUR 4,324 million (i.e. 30.5% of the forecasted GDP), the National Bank said in a press release on Friday.

According to the central bank, in the second quarter of 2023, the net external debt of the country increased by EUR 121 million, or by 2.9%. Observing structure, the private net debt still has greater share in the total net debt with 62%. Compared to the end of 2022, the net external debt increased by EUR 12 million (or by 0.3%), amid higher net public debt (by EUR 88 million) and lower net private debt (by EUR 76 million).

During the second quarter of 2023, the negative net international investment position (IIP) increased by EUR 226 million to EUR 8,357 million, which is 58.9% of GDP forecasted for 2023.

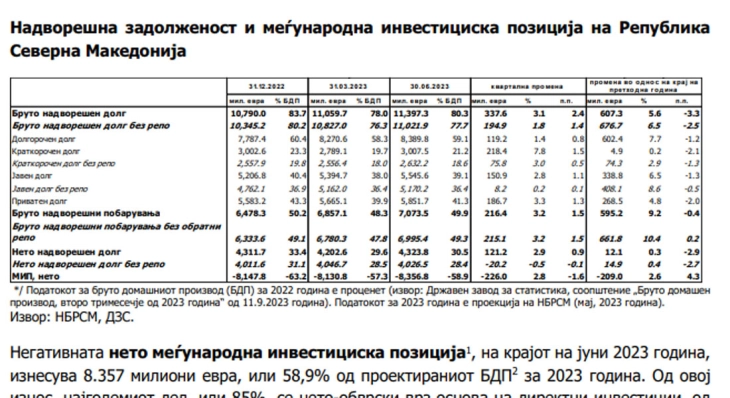

The National Bank’s Statistics Department notes that at the end of June 2023, the gross external debt totaled EUR 11,397 million (or 80.3% of the forecasted GDP) and registered quarterly increase of EUR 338 million (or by 3.1%). Corrected for the effect of the specific foreign reserves management activities of the central bank from the debt, gross debt registers quarterly increase of EUR 195 million.

This quarterly growth, the central bank adds, is a result of the rise in both private and public debt (of EUR 187 million and EUR 8 million, respectively). The growth of the private debt is due to the increased debt of intercompany lending (by EUR 108 million), private banks (by EUR 41 million) and non-banking private sector (by EUR 37 million). The quarterly increase in the public external debt of EUR 8 million is a result of the higher debt of the government sector and public banks and public enterprises (by EUR 6 million, respectively), amid lower debt of the central bank (by EUR 4 million).

Compared to the end of 2022, the gross external debt increased by EUR 607 million, or 5.6%. However, in the first half of 2023, the debt, with the effect of specific activities for foreign reserves management with foreign reserves of the central bank being excluded, increased by EUR 677 million. The growth is due to the increased public external debt (by EUR 408 million) and the increased private debt (by EUR 269 million). The public debt growth is a result of the higher liabilities of the government sector (by EUR 455 million), amid decreased liabilities of public banks and public enterprises (by EUR 42 million). Regarding the private debt, growth was registered in intercompany lending (by EUR 292 million) and non-banking private sector (by EUR 42 million) while the debt of private banks decreased (by EUR 66 million).

At the end of the second quarter of 2023, the gross external claims amounted to EUR 7,074 million (or 49.9% of the forecasted GDP) and registered quarterly increase of EUR 216 million (or by 3.2%). If we exclude the effect of the central bank specific activities related to foreign reserves management, the gross external claims are higher by EUR 215 million and amount to EUR 6,995 million. This quarterly growth is a result of the higher private and public claims (by EUR 168 million and EUR 48 million, respectively).

“The quarterly growth of the external claims of the private sector is a result of the increased claims of intercompany lending (by EUR 115 million), deposit-taking corporations (by EUR 50 million) and other sectors (by EUR 3 million),” the National Bank points out.

The growth of public claims is due to the increased claims of the central bank.

Compared to the end of the preceding year, the gross external claims increased by EUR 595 million. If we exclude the effect of the central bank’s specific foreign reserves management activities, the gross external claims are higher by EUR 662 million, as a result of the increased private and public claims (by EUR 344 million and EUR 318 million, respectively). The rise in private claims stems from the increased claims of intercompany lending (by EUR 312 million) and other sectors (by EUR 87 million), amid fall in the claims of deposit-taking corporations (of EUR 55 million).

According to the central bank, the quarterly increase in the negative net IIP results from the more intensive increase in liabilities (by EUR 467 million) relative to the assets increase (by EUR 241 million). Observed by instrument, the net liabilities based on debt instruments increased by EUR 121 million, while net liabilities on equity instruments increased by EUR 105 million.

Compared to the end of 2022, the negative net IIP increased by EUR 209 million, as a result of the increase in the net liabilities based on equity instruments (of EUR 197 million) and debt instruments (of EUR 12 million).

Photo: Printscreen