PRO thwarts fraud involving VAT refund to oil companies

- The Public Revenue Office (PRO) presented Monday details over the way in which oil companies used false invoices in order to get a VAT refund by way of personal income tax.

Skopje, 15 January 2024 (MIA) - The Public Revenue Office (PRO) presented Monday details over the way in which oil companies used false invoices in order to get a VAT refund by way of personal income tax.

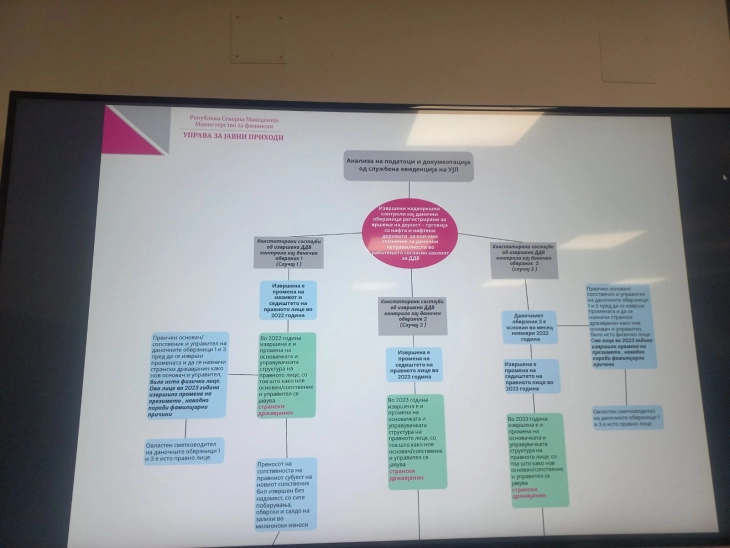

PRO has carried out controls in three companies registered for wholesale and retail trade with oil and oil derivatives. These companies wanted to defraud the laws through change of the title and seat of the legal entity, as well as change of the ownership and management structure, without having registered employees, licenses from the Energy Regulatory Commission, a gas station and a warehouse, using fictitious invoices for amounts in millions of denars.

"The Budget has not been damaged because tax officers prevented VAT refunds in the amount of about Mden 160 million (EUR 2.6 million) and personal income tax worth Mden 19 million (EUR 308,000)," said PRO director Sanja Lukarevska.

The PRO submitted evidence to the Ministry of Interior on 15 November 2023 and to the Financial Police Office on 1 December 2023.

On the solidarity tax, the PRO has forced its collection from eight taxpayers, with seven procedures already completed.