National Bank: Green loans up 55% in past 2.5 years, still low share of total loans

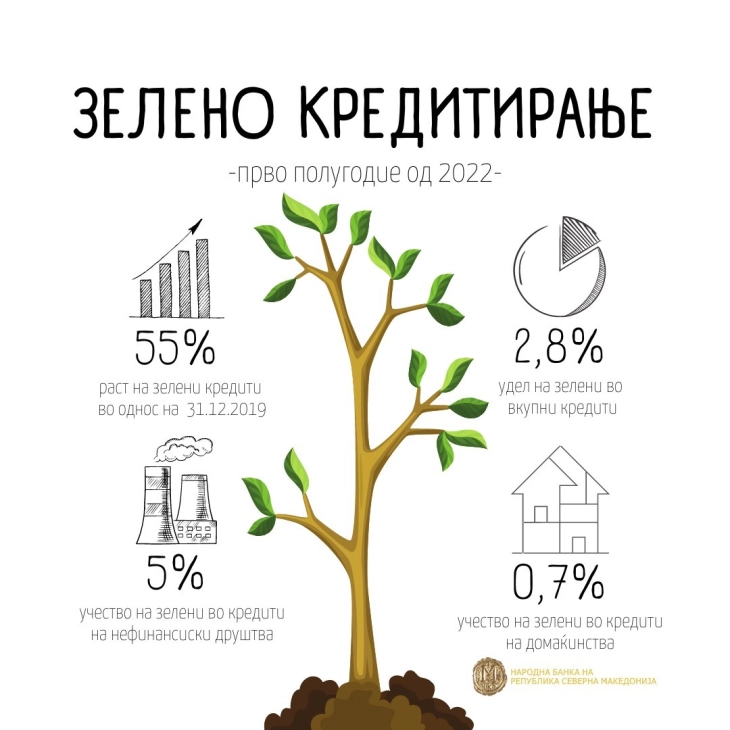

Skopje, 9 November 2022 (MIA) – In the past two and a half years, green lending has increased by 55 percent. This refers to loans intended for projects that support sustainable, environmental goals, or goals that contribute to the green transition, such as the development of new environmental technology. The share of green loans in total loans is growing as well, however it remains low. From the beginning of 2019 and up until the first half of 2022, the share of green loans in total loans has risen from 2.2 to 2.8 percent, said the National Bank on Wednesday and added that they will continue their activities encouraging and raising awareness about green lending.

According to the National Bank’s data, at the end of the first half of 2022, bank claims based on green loans amounted to 11.136 million denars. In comparison, at the end of 2019 this figure stood at 7.176 million denars. The growth of green lending is mostly due to loans taken by companies. From the end of 2019, and up until the first half of 2022, green loans granted to companies have grown by 3.748 million denars and make up 5 percent of the total loans granted to companies. The growth of green loans among households is lower and they make up only 0.7 percent of the total loans in the “households” sector.

“Climate change negatively affects economic growth and inflationary pressures, especially in less developed economies. More and more central banks consider green financing to be a part of their mandate. Recognizing the long-term risks of climate change, the National Bank has taken a proactive stance and has set the contribution to a green sustainable economy as one of its strategic goals,” said the National Bank.

Through a set of activities, said the Bank, the National Bank is encouraging green financing. Some of them include monetary measures, such as the decision to change the reserve requirement instrument, which motivates lending to projects related to domestic production of electricity from renewable sources. With this decision, the basis for allocating funds to the reserve requirement by the banks is being reduced by the amount of the newly approved loans which finance projects for domestic production of electricity from renewable sources.

Additionally, the National Bank is drafting a strategy to encourage green financing, which includes a series of activities, including the preparation of guidelines for the banks’ operations in the field of green finance, as well as transparent financing. A green portfolio of securities in the foreign currency reserves is being built, and since this year the National Bank has also established a system of collecting more detailed data on green financing. Stress tests are planned to assess the resiliency of the banking system to climate change, for which it will be necessary to strengthen the institutional capacity of both the regulator and the banks. ad/ik/