National Bank: Average interest rate on newly granted household loans at 5.40% in March

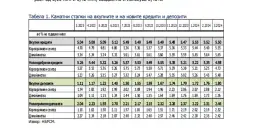

- The National Bank of North Macedonia said the average interest rate on outstanding loans equalled 5.50% in March 2024 and registered a monthly decrease of 0.02 percentage points, while annually it increased by 0.46 percentage points. The average interest rate on the outstanding amounts of deposits amounted to 1.80% and registered a monthly and annual increase of 0.04 and 0.69 percentage points, respectively.

- Post By Angel Dimoski

- 11:30, 30 April, 2024

Skopje, 30 April 2024 (MIA) - The National Bank of North Macedonia said the average interest rate on outstanding loans equalled 5.50% in March 2024 and registered a monthly decrease of 0.02 percentage points, while annually it increased by 0.46 percentage points. The average interest rate on the outstanding amounts of deposits amounted to 1.80% and registered a monthly and annual increase of 0.04 and 0.69 percentage points, respectively.

According to the data published by the National Bank on Tuesday, the average interest rate on the newly granted loans equalled 4.98% in March, which is a monthly and annual decrease of 0.37 and 0.28 percentage points, respectively. The average interest rate on newly received deposits registered a monthly and annual growth of 0.15 and 0.42 percentage points respectively, and amounted to 2.46%.

“This month, the average interest rate on newly granted household loans amounted to 5.40% and decreased by 0.05 percentage points on a monthly basis. The downward change is due to reduced interest rates on denar loans with currency clause and foreign currency loans (by 0.12 and 0.07 percentage points, respectively), amid growth in denar loans without currency clause (of 0.10 percentage points). On an annual basis, the interest rate on the newly granted household loans increased by 0.17 percentage points,” said the Bank.

In March, the interest rate on the outstanding amounts of household deposits equalled 1.76% and registered a monthly increase of 0.03 percentage points. The change is due to the increase in interest rates on denar deposits without currency clause (of 0.03 percentage points) and interest rates on foreign currency deposits (of 0.02 percentage points), while interest rates on denar deposits with currency clause decreased (by 0.01 percentage point). On an annual basis, this interest rate increased by 0.72 percentage points.

“This month, the interest rate on newly received household deposits6 registered a monthly growth of 0.07 percentage points and equalled 2.42%. The upward change is entirely due to the growth of interest rates on newly received foreign currency deposits (of 0.19 percentage points), amid unchanged interest rates on denar deposits without currency clause. This month banks and savings houses did not report newly received denar deposits with currency clause. Compared to March last year, the interest rate on newly received household deposits increased by 0.15 percentage points,” said the Bank.

In March, the average interest rate on the outstanding amounts of corporate loans amounted to 5.35% and decreased by 0.05 percentage points, on a monthly basis. The downward change is due to the decline in all components, as follows: the interest rates on foreign currency loans (of 0.09 percentage points) and the interest rates on denar loans with and without currency clause (of 0.05 and 0.03 percentage points, respectively). On an annual basis, the interest rate on the outstanding amounts of corporate loans increased by 0.65 percentage points.

The Bank said that in March, the interest rate on newly granted corporate loans registered a monthly decrease of 0.52 percentage points and equalled 4.73%. Analyzed by currency, it said, the change is due to the reduction of the interest rates on all components, as follows: denar loans with and without currency clause (of 0.60 and 0.54 percentage points, respectively) and foreign currency loans (of 0.24 percentage points). On an annual basis, this interest rate decreased by 0.54 percentage points.

The average interest rate on the outstanding amounts of corporate deposits registered a monthly increase of 0.04 percentage points and equalled 2.12%. Thus, the change is due to the increased interest rates on foreign currency deposits (by 0.17 percentage points) and interest rates on denar deposits with and without currency clause (by 0.14 and 0.01 percentage points, respectively). Compared to March last year, this interest rate is higher by 0.38 percentage points.

“This month, the interest rate on newly received corporate deposits4 increased monthly by 0.33 percentage points and equalled 2.52%. The growth is due to the increased interest rates on deposits without currency clause and the interest rates on foreign currency deposits (by 0.55 and 0.09 percentage points, respectively), amid reduced interest rates on denar deposits with currency clause (by 1.52 percentage points). On an annual basis, this interest rate increased by 1.42 percentage points,” the National Bank said.

Photo: National Bank