Biden and McCarthy reach last-minute deal to raise US debt limit

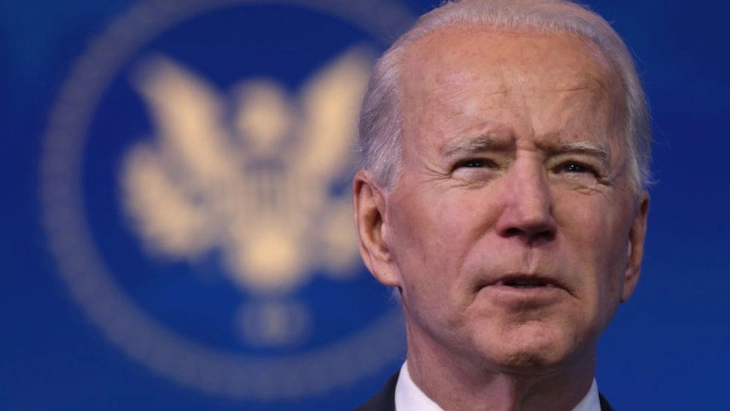

- US President Joe Biden and House Speaker Kevin McCarthy reached what both men called an “agreement in principle” on Saturday to raise the federal government’s borrowing limit and cut some spending, as they sought to end a months-long stalemate that brought the government to the brink of defaulting on its credit for the first time.

- Post By Silvana Kocovska

- 11:33, 28 May, 2023

Washington, 28 May 2023 (tca/dpa/MIA) — US President Joe Biden and House Speaker Kevin McCarthy reached what both men called an “agreement in principle” on Saturday to raise the federal government’s borrowing limit and cut some spending, as they sought to end a months-long stalemate that brought the government to the brink of defaulting on its credit for the first time.

The deal must still pass Congress. Its failure could upend the global financial system, jarring markets from Tokyo to London, jeopardizing Medicare and Social Security payments and calling into question the United States’ role as the world’s most reliable economy.

McCarth said that he and Biden had agreed to a two-year increase on the $31.4-trillion debt ceiling, extending the nation’s borrowing limit until after the 2024 presidential election. The White House said it would accept temporary spending caps on nondiscretionary funding, tougher work requirements on social safety net programs and permitting changes to speed up energy and gas projects.

McCarthy said that he and Biden had spoken twice on Saturday and that “we still have a lot of work to do. But I believe this is an agreement in principle that’s worthy of the American people.”

The bill has “historic reductions in spending, consequential reforms that will lift people out of poverty into the workforce,” the speaker said.

He said he expected that the bill would be written and posted by Sunday, with a House vote on Wednesday.

Biden, in a statement late Saturday, called the agreement “an important step forward that reduces spending while protecting critical programs for working people and growing the economy for everyone.”

He said that the agreement protects his signature legislative accomplishments but conceded that it “represents a compromise, which means not everyone gets what they want.” He urged Congress to approve it quickly to avoid “catastrophic default.”

McCarthy and the White House will need dozens of Democrats to back the bipartisan plan in order to pass it in the narrowly divided House. Both the House and the Democratic-controlled Senate need to pass a bill by June 5, when the Treasury Department projects the government will run out of cash to pay its bills.

A default could trigger economic chaos that could potentially cascade across global financial markets and devastate millions of Americans. The White House has warned it would disrupt payments to Social Security beneficiaries, government employees and members of the military.

A default would almost certainly knock the already fragile American economy into a recession and risk causing irreparable long-term damage to the credibility and safety of the U.S. dollar, the reserve currency that anchors the global financial system.

The U.S. has trillions of dollars in outstanding debt, and missing interest payments on its obligations would shock stock markets and sharply raise the cost of borrowing to finance Washington’s deficit spending, ultimately rippling through businesses and consumers.

The threat of a default has had Wall Street on edge — stocks have been trending lower in recent days — but the damage was mitigated by investors’ expectation that even die-hard partisan politics wouldn’t dare allow a breach to the debt ceiling. They knew that if there’s a default, “there’s no way to hide,” said Ryan Sweet, chief U.S. economist at Oxford Economics.

“Up and down the income and wealth spectrum, it would be an economic catastrophe,” Sweet said.

On Wednesday, credit rating agency Fitch placed the United States’ AAA rating on negative, warning of a potential downgrade if lawmakers fail to pass a deal. The agency said that “brinkmanship over the debt ceiling” threatened the U.S. rating — the highest available — but it expected a resolution before the projected June 5 deadline.

The government narrowly averted a default under President Barack Obama in 2011, but Standard & Poor’s downgraded the U.S. credit rating as a result of that fiscal showdown.

Photo: MIA archive